Early on in the COVID-19 pandemic a number of beer writers talked about how the pandemic would take a toll on craft breweries, myself included. More recently some of the corporate media have been speculating about what will become of the industry in an almost post-COVID (we all hope) world of inflation, labour shortages and an emerging new normal. Two of my early takes can be read here and here. Today I want to reflect upon what was said then and now and what it all might mean.

Early on there were many predictions (myself concluded) suggesting that the combination of pandemic restrictions, supply chain disruptions and general economic slowdown was going to present problems for craft beer in Canada. Most observers expected a contraction in the number of breweries in the country and increased financial stress for those that survived.

The latter prediction was, unfortunately, stunningly accurate. I haven’t spoken to a single brewery which didn’t talk at length about how difficult the past two plus years have been on their financial statements. Cash reserves depleted, cash flow drying up. The need to acquire more debt and/or extend existing commitments. Delayed investments. Laid off staff. Brutal.

As a quick aside, most breweries say that government supports were a lifeline during the worst of the restrictions. Many said without them, it would have been an even harder go. A good reminder that governments can play an important role in times of crisis.

The prediction of closed breweries didn’t really pan out – at first. When I did my spring update of the state of Canadian craft beer (which you can read here), I was surprised at how few breweries had closed over the previous 18 months or so. More weathered the storm than expected. However, in recent months I have noticed that the number of announced closures, mergers and sales across the country is pacing new openings. Closures are difficult to track with accuracy – new breweries are happy to announce their arrival, but closing breweries often quietly creep off in the night, either due to hopes that it will be temporary or just from sheer exhaustion. A case in point was Edmonton’s Yellowhead Brewing, which disappeared without a peep (read here). Alberta has seen a spate of recent closures with only some coming with a public announcement, as I reported here and here. Ontario has been a particularly active site for brewery upheaval, something predicted by the unmatched Jordan St. John.

I think the closures we are seeing at the moment are just beginning. There is only so long breweries can limp along with reduced sales and messed up fundamentals. Likely the government supports provided a lifeline for many for a while, and with their departure the hounds finally broke through the door. We are just coming out of the first truly “open” summer since 2019, and as winter hits, I suspect more breweries will finally hit the financial wall.

More recently, media commentary has focused on how inflation, increased competition and declining beer consumption spell more tough times ahead for craft breweries. I will just observe that the latter two factors have been cited for a decade to predict a craft crash that never came. Clearly the economics of craft beer is more complicated than business page editors and business professors understand.

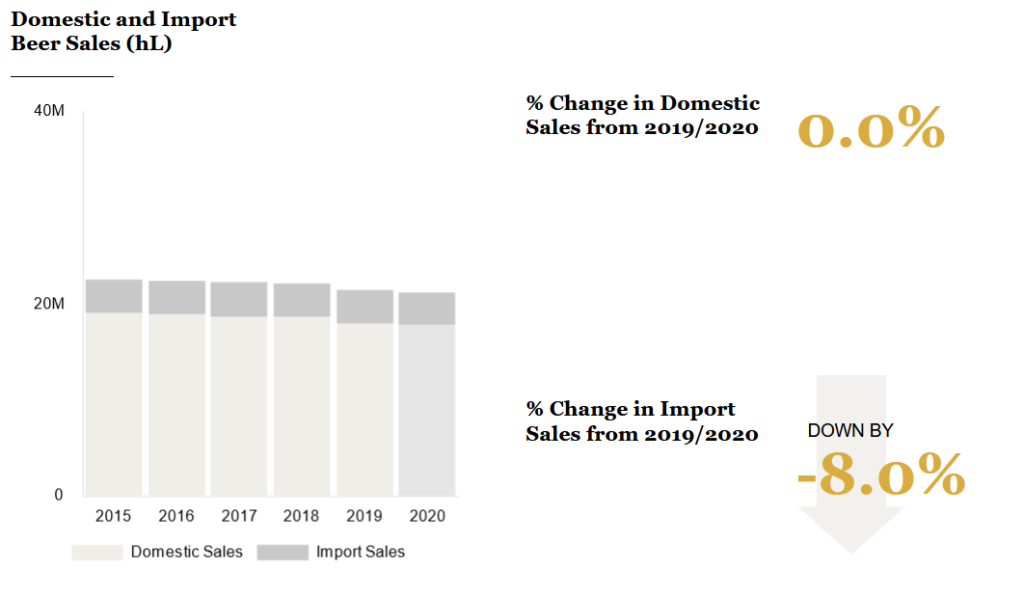

Yes, beer consumption overall is declining, but the decline is greatest among domestic brands and (during COVID at least) imports. The craft segment remains fairly robust, buoyed by increased interest in buying local. The pie may be getting smaller, but craft’s slice is of the pie continues to grow, or at least holds its own. That can’t continue forever, but people have been predicting “oversaturation” for as long as I have been writing this blog. In a recent presentation the Brewers’ Association Chief Economist Bart Watson noted there is a mixture of challenges and opportunities for craft beer in the current beer economic climate.

In my opinion increased competition has one main consequence – improved quality. A handful of breweries drop by the wayside, but most craft brewers have proven quite adept at upping their game as competition heats up. I will say it again, the dynamics of a growing industry are complex and less predictable than we would like to think.

Finally, inflation, in the short term, does concern me. Price increases for key inputs, including malt, aluminum, transportation and energy consumption pose a real challenge. Craft beer is more price elastic than domestic corporate beer, but it is not a contortionist. There is a limit to how much a brewery can hike prices. In Alberta, for example, there is a real psychological barrier at $20 for a six pack (or four pack tallboys). An increase from $17 to $18 will likely not be noticed. Add a two to the beginning of the sticker and watch sales plummet. Plus, when personal finances are tight, a consumer is less likely to splurge on that $20 bottle of barrel-aged stout/wild ferment ale/Belgian Quadrupel and opt for something just as delicious but less expensive.

Yet, inflation is expected to be a short term problem (likely followed by a recession, only compounding problems). That is not to say that we will see deflation (a reduction of prices), meaning higher costs are here to stay (I will spare you the lengthy discussion of the economics of inflation). But hard times make for tough decisions, and if the pandemic proved anything, craft breweries are particularly good at making fast pivots.

My core point is this: it has been a brutal couple years (there can be no denying that), and the consequences of COVID are not yet done with craft beer, but the worst is behind us. There is now space for breweries to breathe a little, re-orient to what aspects of the post-COVID world require a business shift, and repay some of those debts. We will see more closures in the coming months, of that I am certain. The rumour mill is far too active for me to think that is behind us.

But I am less concerned about the other economic contexts facing craft beer. It is all stuff we have seen before, and never have the doomsayers been right. The craft boom is over, but it is now settling into a steady period of growing maturity. Of course, inflation and a coming recession leave me gravely concerned for the wellbeing of average families. But the site is called Onbeer, not Onworkingfamilies. Maybe one day I will start a site about working families, as I have things to say about that too.

For now, it is about beer. And beer is doing just fine. Individual breweries are gasping for air and scratching toward the end of this hellish two years. But most of them will make it.

Leave a Reply