I appreciate my last couple posts have been, well, a bit depressing. Highlighting brewery closures is not my favourite part of the job. In the new year I hope to offer up the flipside and talk about some of the new breweries recently or about to open. But first, as we near the end of 2022, I thought I would take stock at where the Alberta beer industry is and where it is going in the next couple years. Be warned: stats coming up!

Alberta Beer Industry Yesterday and Today

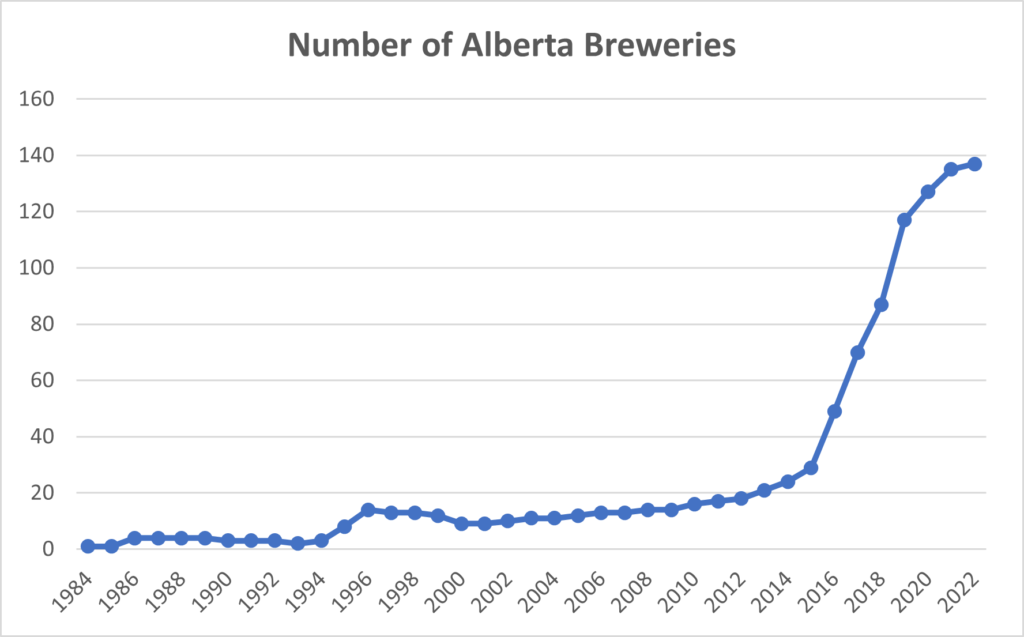

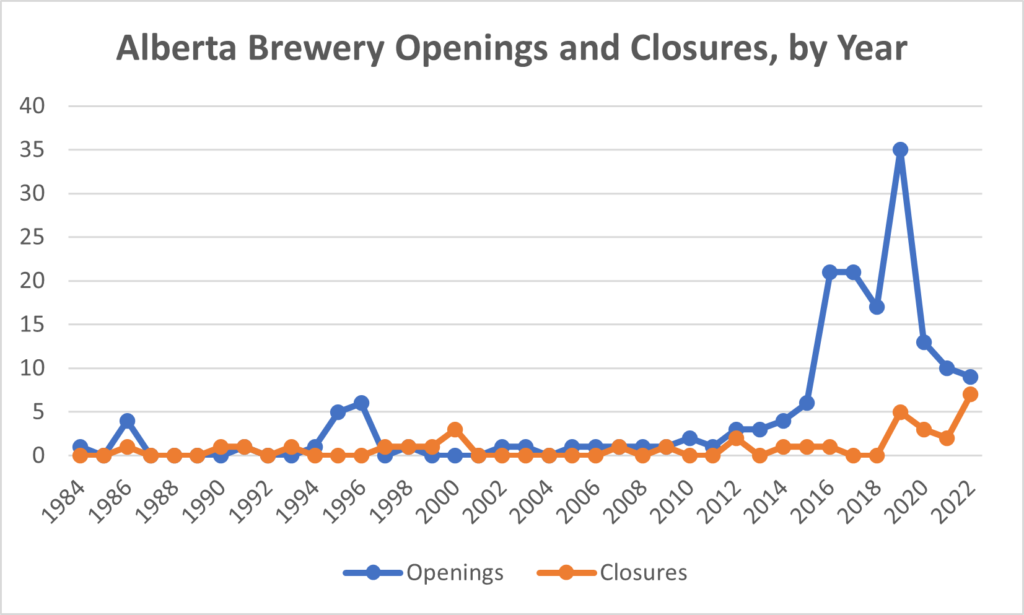

As we close out 2022 (I am assuming no new breweries will open in the next 10 days), Alberta has, using my definition, 128 brewing companies. There are 137 active licenses, but I don’t count multiple licenses owned by the same corporate entity. There were seven new breweries opened in 2022, along with five closures.

I have written about the industry’s explosive growth between 2015 and 2020 before (here and here, for example). I have also tried to put that growth into context, as it is quite remarkable. I have improved upon previous attempts in this iteration. In particular I went back and cleaned up my records for the period 1984 to 2000, which I knew had some holes. I am now pretty certain I have captured every single brewery that has opened and closed in the province since 1984.

With that new data, I have plotted the number of breweries operating in Alberta since that date and the the openings and closings each year. The charts below tell the story. (NOTE: For this exercise I disregard ownership to better reflect the ebbs and flows of the industry)

A few things jump out at me. First, that climb in total breweries starting in 2015 is insane! More importantly for our purposes here, what was suspected in 2021 is now clear. The expansion phase of the industry, in terms of new breweries, has come to an end. New breweries are still opening – 2022 was the seventh most active year for new breweries in history – but what has changed is we are starting to see more closures. The peak of new operations has clearly come and gone. The question is what is the closure trend. More on that in a moment.

Every time I look at these charts, I am reminded just how important beer policy is. Alberta had backward licensing and zoning rules through the 2000s and early 2010s and it shows. Market environment matters, but policy can aid or hinder. Let Alberta be a case study of that.

The charts also tell me two other things. First, historically, it is really interesting (now that I have more accurate data) to see the little mini-bump of new breweries in the mid-1990s, followed a couple years later of a small bump in closures. Then things got real quiet.

Second, I think the trend toward increased closures was beginning in 2019, before COVID-19, and , ironically, the pandemic paused the increase. This is somewhat counterintuitive. One would think that the stresses of the pandemic measures would hasten the closure of a brewery on the brink. Once again I think government policy, this time income support policy, is the reason. The rush of government supports to individuals and businesses early in the pandemic provided a lifeline for many breweries. I discuss this phenomenon at greater length in this post, but these statistic shore up that argument.

The number of breweries is only one measure of an industry’s strength. Unfortunately sales data is hard to access in Alberta as the AGLC holds that stuff pretty close to the chest. However, a report by Beer Canada (frustratingly not available online) indicates sales (I assume by volume) in Alberta dropped 10.3% in 2022. This is on top of more modest drops in 2020 and 2021. Per capita beer consumption in the province dropped 23% between 2015 and 2020 (last year data is available), continuing a long term decline.

However, Alberta craft beer seems like it continues to climb, despite overall trends. The Alberta Small Brewers Association (ASBA) claims independent breweries in Alberta possess 15% of the market share. I cannot independently confirm that figure, but I trust they are getting that information from AGLC so will go with it. This is up significantly from a few years ago. Just before the new brewery boom, I estimated the share to be seven to eight percent, a number that included Big Rock’s 5% share. That means craft beer’s share has doubled in recent years. More significantly is the fact that Big Rock is still roughly the same size, so all of that growth is from the smaller breweries in the province.

Lots of healthy numbers there.

Where is Alberta Beer Going?

That is where the rosy talk comes to an end. What is to come?

I am loathe to make predictions (hell, I predicted Can

ada would make it out of its group at the World Cup and how did that turn out?), especially since the rough seas of the COVID pandemic have not fully eased. Yet I think some patterns are relatively clear.

First, the trend lines on new breweries tells a straightforward story. We will see fewer new operations in the next couple years and an uptick in closures. My guess is that the churn will lead to a form of equilibrium – openings and closures will be roughly equal. So, by that logic, I guess I am arguing that closures will mark the next couple years but we will not see a significant retrenchment. We will likely lose a handful of breweries each year, but they will be replaced by a handful of new ones. In other words, an industry that is settling after a raucous expansion period.

Second, The growth in market share will continue, but not at the pace we have seen. The low hanging fruit is gone. Local beer now possesses significant shelf space in liquor stores, in many places greater than its 15% share warrants. With more and more breweries, there will be greater competition for that space, with brewery A being replaced by brewery B. That is not a model for increased market share overall.

There may be more room for expansion in pubs and restaurants, but the lingering COVID effects are keeping hospitality owners conservative a while longer. Where the hope for growth is, in the short term, tap room traffic. In a way breweries are becoming competition for bars among a particular slice of the consumer looking for a quieter, more relaxed experience.

But mostly I make this argument based on numbers. If we look at B.C. and Ontario, for example, they are hovering in the 20% to 25% level. The market fundamentals in Alberta are no different (I exclude Quebec for a reason as I believe their market is fundamentally distinct), meaning – over time – there is more space for growth. That next ten percent, however, will come more slowly than the last ten percent.

The other key factor both limiting growth and leading to closures is inflation. Beer prices are up 10-15% over the past year (which will lead to reduced consumption in the short term – thus lengthen growth curves). Increase in input costs for breweries, I am told, are higher than that. The math doesn’t work there, does it? Breweries are eating some of their increased costs, partly in hope it eases soon and partly because they must to remain competitive. Depending on how quickly inflation eases, and how bad of a recession combating it creates, this could create serious headwinds for the industry.

Finally in the medium term the Alberta craft beer industry will have to come to terms with the looming trends in beer consumption. It is declining! An aging population, new “beer-like” options such as hard seltzers, and growing recognition of the problems of excessive drinking and addiction are all factors that are not going away. Some, like age demographics, will accelerate in the next ten to twenty years. Craft is avoiding these issues now because they are still in a growth phase. When that growth stops, it will likely not be pretty.

In all, I think it is still arrows up for the Alberta beer industry, for now. But breweries will need to get smarter as the days of (almost) guaranteed success are over. Breweries will have to earn their customers and watch their pennies.

December 15, 2022 at 10:05 AM

Very interesting. Is the raw data from your charts available anywhere? What breweries opened/closed in the 90s?

December 15, 2022 at 11:29 AM

Hi Patrick,

I keep a database of breweries across Canada, which is what I use for my raw data. I cobble it together from a range of sources.

I will give some thought about how to present some of that data in an interesting way. Maybe a post looking specifically at the 1990s?