A new research report was released last week examining the economic case for the privatization of the SLGA in Saskatchewan. Called A Profitable Brew: A Financial Analysis of the SLGA and Its Potential Privatization (you can find a link to the PDF at this website), it was published by the Parkland Institute and the Saskatchewan branch of the Canadian Centre for Policy Alternatives. It is, as these kinds of reports are, full of numbers and fairly technical talk and thus likely desired reading for only the more policy wonkish of you (a crew with which I associate myself). However, since I taken a keen interest over the years on the consequences of liquor policy, and privatization in particular (find some samplings here and here and here), I thought I would briefly summarize its findings.

A new research report was released last week examining the economic case for the privatization of the SLGA in Saskatchewan. Called A Profitable Brew: A Financial Analysis of the SLGA and Its Potential Privatization (you can find a link to the PDF at this website), it was published by the Parkland Institute and the Saskatchewan branch of the Canadian Centre for Policy Alternatives. It is, as these kinds of reports are, full of numbers and fairly technical talk and thus likely desired reading for only the more policy wonkish of you (a crew with which I associate myself). However, since I taken a keen interest over the years on the consequences of liquor policy, and privatization in particular (find some samplings here and here and here), I thought I would briefly summarize its findings.

First, I have to say the report offers one of the most comprehensive explanations of how liquor distribution and retail occur in Saskatchewan that I have ever read. If you want to understand the province’s rather complex system, read pages 6-14.

The study’s overall assessment is that privatization would be a bad economic move for Saskatchewan citizens resulting in the loss of potentially hundreds of millions of dollars in revenue. Their main argument is that the SLGA is currently a highly profitable operation and any private option would invariably lower the profitability of the sector. The paper doesn’t say this openly, but the loss of revenue would require either cutbacks to government spending or new sources of revenue (taxes) to make up for the missing money.

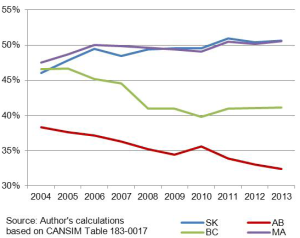

The most intriguing aspect of their argument is their comparison of the economic performance of liquor retail in the four western provinces – two of whom have public retail (Saskatchewan and Manitoba), one a mixed system but growing increasingly private (B.C.) and one wholly private (Alberta). The numbers are striking. The chart to the right tracks Gross Profit Margin in each province. Alberta is that sad little red line dropping and dropping. B.C.’s drop is associated with its first major shift to private options.

The most intriguing aspect of their argument is their comparison of the economic performance of liquor retail in the four western provinces – two of whom have public retail (Saskatchewan and Manitoba), one a mixed system but growing increasingly private (B.C.) and one wholly private (Alberta). The numbers are striking. The chart to the right tracks Gross Profit Margin in each province. Alberta is that sad little red line dropping and dropping. B.C.’s drop is associated with its first major shift to private options.

The main culprit in Alberta’s sagging profit margins is the increasing cost of wholesale product. Wholesale costs grew almost three times faster in Alberta and B.C. than Manitoba and Saskatchewan over the past decade. This statistic might explain why Alberta beer prices are, inexplicably to some, higher than other provinces.

The reason is simple. First, having a single buyer and distributor is a form of vertical integration. Allow me to quote from the study:

One reason integration can control wholesale costs is that liquor suppliers need only deal with a single entity in order to sell their product across the entire network. There is no need for the liquor suppliers to intensively sell their products at the retail level, and therefore the marketing and administration costs of the suppliers are minimized, which can result in lower purchasing prices. Under a privatized retail system such as Alberta’s, there are hundreds of retailers with which a liquor supplier or agent might have to interact. (p. 23)

Second, privatization leads to a more complex distribution system. To again quote from the report:

Wholesale costs also increase with the complexity of the retail system. A fractured retail market composed of numerous small, competing stores can also place undue strain on the distribution system. A study on Alberta’s distribution system shortly after privatization found that the cost per case delivered rose 72% due to the increased number of smaller shipments. (p. 23)

Now, maybe as a beer consumer you don’t care about profit margins and wholesale costs. You just want access to good, craft beer at reasonable prices. Aye, there is the rub! Higher costs in the system inevitably leads to higher prices on the shelves.Again, this is why Alberta’s prices are so high. What may seem like consumer-friendly policies (more stores! more selection!) have an unattractive dark side.

Plus we cannot, as citizens, just ignore the spectre of lost revenue. The report estimates that if Saskatchewan adopted an Alberta model, it would lose approximately $65 million in revenue annually. That is about six dollars per man, woman and child in the province that would need to be made up via cuts to services and/or increases to other revenue streams. Remember Alberta’s privatization scheme occurred at the same time as some of the deepest cuts to public services in the province’s history.

I am well aware that there are many legitimate criticisms of the SLGA, especially from the perspective of craft beer producers (both in and out of the province). There is no question reforms are needed. But the government is not asking producers and consumers what would make the SLGA retail system better; it is talking about scrapping it all together. And there are signficant doubts that such a move is a good one.

Leave a Reply